Kanawath / istock via getty images

The one of the greatest edge is an investor with a long orientation. – Seth Klarman

Bases against emotions

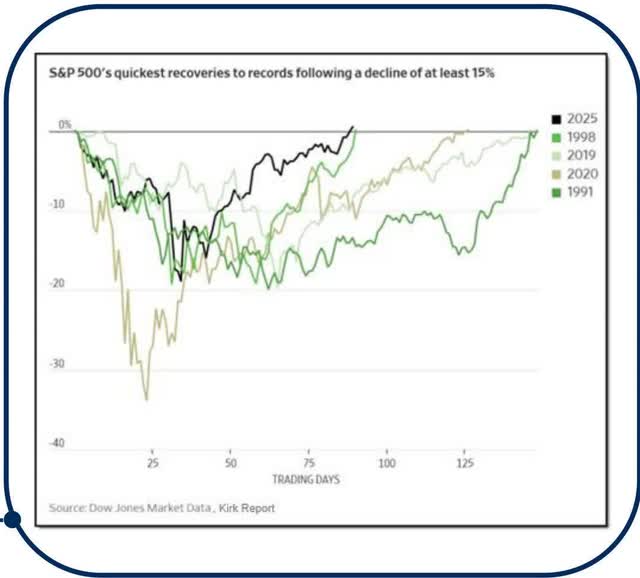

The quote at the beginning of our last spring newsletter comes from the bill miller saying, “Great Empelops is not good when everyone else is worried about when everyone is worried about it all is worried when everyone’s worried.” As we published our spring investor letter it was two daily trades from April 8 under market. We have written that in the first quarter separation the market may not work very well on the basics and that certainly happens. The S & P 500 Index (SP500,, Supmohan) Erased 19% reduction in a record of 55 trading days, the easiest recovery in a tall record. As mentioned by Ned Davis Research, “Index ends Q2 with a gain of 10.6%, the best quarter from Q4 2023 and the eleventh best quarterly returned 25 years.”

A couple of reasons contributed to a favorable recovery of US equities with an important consequent results. In the fourth quarter of 2024 and the first quarter of this year, the actual results of the income exceeded the analyst expectations. According to the real estimated income growth rate for Q2 2025 is 9.4%. Although this growth rate is lower than the expectations of the year due to concerns about Tarko and inflation that reports to profits for Q2 2025 are more expected than historical average. Other causes contributed to the positive equity market is the impact, or lack of it, that the tariffs like the economy. Tirsen Sløk, primarily economist at Apollo Global Management, strong against tariffs earlier this year they could lead to a recession. However, in a recent published comment by Sløk, he says,

Perhaps the strategy is to maintain 30% Chinese tariffs and 10% tariffs in all other countries and then give all the countries 12 months to open their trading economies. The exposure to a year’s deadline will provide countries and US domestic businesses during the new world’s adjustment, which can be maintained with a quick decrease, which can be kept in a quick-term, which can be positive in business, work, and business marketing. It seems like a victory for the world and yet make 400 $ billion annual income for US taxpayers. Trade colleagues will be happy with only 10% of the US tax tariffs and income taxes will appear. The administration may have enabled all of us all.

In short, many countries we own a business to maintain the tariffs of US products. Perhaps the Trump administration method will only bring in the US position more equilibrium one with no reason keeping inflation.

US dollar and international market return

Early expectations surrounding Trump’s economic policy suggests to raise tariffs that cost imported goods, in such a decrease in consumer products. Usually, tax cuts will be expected to stimulate household growth by encouraging investment and expenditure, the factors that are often related to a reinforcing US dollar. However, the actual economic performance is mixed, and the passage of a large beautiful legislative action introduces concerns about long budget deficits. As a result, the dollar is weak, reduced approximately 10% year by date.

In addition, a weak US dollar can improve the performance of International Investments for US investors. If the dollar is preferred by the relations of foreign currency, the value of overseas property, such as international stocks and bonds, likely to rise when returned to the dollar. This currency effect can enhance returns on foreign holdings, providing a natural hedge against the US as global investors DIVERSIFY away from US assets due to concerns, international markets may become more attractive Investments for Investors domiciled in the US

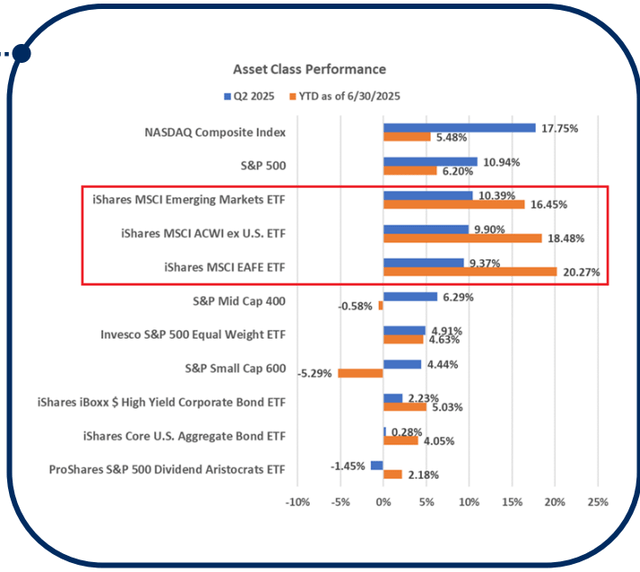

The adjacent bar chart describes the portrayal of many asset classes for the second quarter of 2025 and year until June 30, 2025. The three indexes are presented within the Red square Color bars at stake showed years of return of the year, where international benchmarks are more overperformed other asset classes in the chart. On the contrary, blue bars represent the second quarter, with US categories, especially at the end of the chart, which turns out to their international counterparts. This pattern indicates that international properties led by the first quarter, while US assets have obtained a relative strength in the second quarter.

Government debt

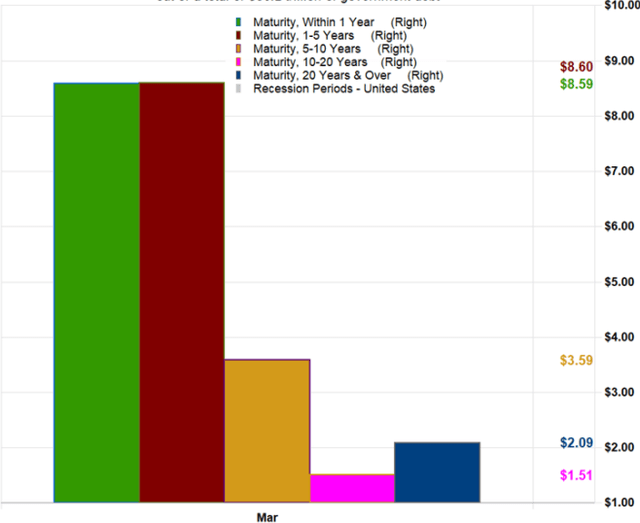

With the new passage of a large beautiful bill, from an initial action extraction, tax cuts to end at the end of this year are expanded. Obbba unanswered is the issue of budget deficit. A point of view expressed by some stronger economic growth can generate higher tax income. If it does not have the purity of this possibility, an aspect of the budget is the fact that budget deficit continues to run about 2 trillion. In addition, almost 47% of public government debt held by private investors portfolios will take five years or less. The amount of debt losing within one year worth $ 8.6 trillion. Most of these adult debts are in low interest interests to withdraw debt, with new issuance, place the budget pressure increase in interest rise while increasing increases increase

In addition, as the increase in supply, bond prices have fallen and the crop of new given debt will rise. As previously mentioned, this higher debt level contributes to the US dollar weakness.

Improvement of feeling

Often, the investment sentiments recovered after falling on the tarump administration’s tarff fixtures in the early April.

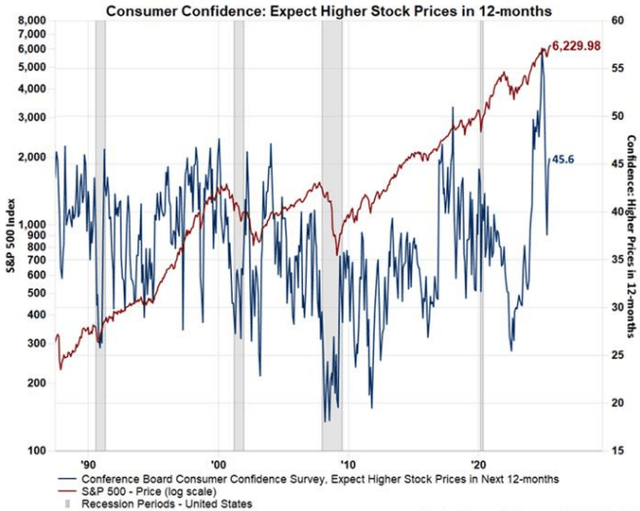

As shown in the chart, the conference reading of the consumption expectations of stock prices shows 45.6% expect higher stock prices in the next 12 months. It is from 37.6% in April. The current reading of 45.6% is put it at the top end of the longterm reading range. This higher level of trust reflects the other steps and is likely to contribute to a trend of trading trend.

The amount thought of whether the true steps of the sentiment are mostly contrarian indicators, ie, investors are always more positive in the market gigput. It is related to the Warren Buffett quote, “fear if others are selfish and greed if others are scared.” It is just as consumers expect about future stof prices not in an intense, the American Association of Individual Surveys in the sense of investors appeared to be excessively suffering, but again, not in severe.

Finally

The long-term recession predicted in recent years was not determined and the US economy was played again. US consumer strength continues to be supported by low unemployment and solid housing prices. As we see signs of some excavation, unemployment rate continues. Corporate America continues to contribute healthy growth in earnings and generally in solid financial form. The potential of artificial advance of intelligence gives excitement for future opportunities. Markets continue to maintain an enthusiastic eye of the economy and the potential intersection rate. Total inflation pressures seem to go on, which should allow the Federal Reserve to reduce the short term interest in interest. With disadvantages of the disability underlined, the higher interest in interest may not fall and can rise. Many tax policy safety after passing OBBBA issues and tariffs that begin to solve a stronger view for corporate and individual corporation investment.

Thank you for your continued trust and support of Horan’s wealth and we can always use to answer your questions and discuss our viewpoint. Please be sure to visit us for company news, reports, and our blogs in Insights.