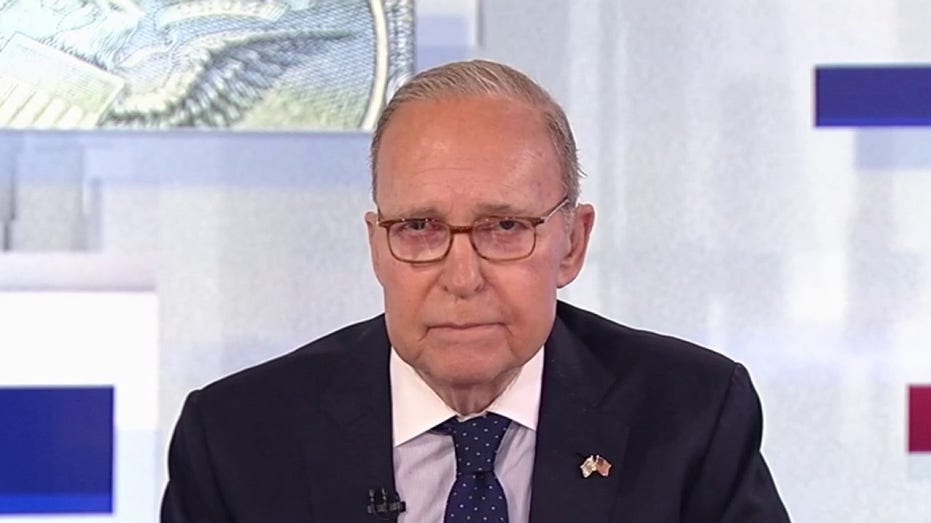

The Fox Business Host Host Larry Kudlow is talking about how taxable tax can help reduce the reduction in ‘collap.’

According to the Congressional Budget Office (CBO), President Donald Trump’s “Great, beautiful bill” cut taxes by $ 3.7 trillion while raising disabilities by $ 2.4 trillion in a decade.

CBO makes progress based on information provided by Congress when considering law which includes spending and tax. But is it always?

Not according to Larry Komblow. During his show on Thursday, outlined how the Congress Office has related 2017 tax deduction, Trump’s signature in his first term.

“Current costs of tax cuts in 2017 should be zero. Why do they need zero? Because they have more than seven years,” Kudhow said.

Trump migging bill cut tax by $ 3.7t, add $ 2.4T to disability, says CBO

President Donald Trump took a question from a journalist at the Oval Office of the White House on May 5. (Anna moneymaker / getty images / getty images)

He added, “So the current policy should not score. The disability should be neutral. Now, I believe with a $ 4 growth in the goals of disability deficiency.”

Kudlow continued, offering some caveats, but found CBO estimates in GDP of 1.8%, which is a low number.

“You can play with the numbers interactively. If you have lowered progress, we will tell 2.6%, perhaps you will lose two trillions of revenues and discomfort,” he said. “Or if you want to use the development of CBO 1.8%, perhaps lose the total four trillions of additional income and reduction in deposits.”

Kollol says, “You still go out of the scorecard’s disability, but not as much. But the GOP can stop a $ 4 trillion taxes for the economy.”

Elon Musk wipes the GOP GOP BAX Bill in deficit impact: ‘disgustingly disgusting’

According to Kunlow, it’s not the only time cboched. For example, with cheap act of care, CBO originally estimated up to 25 million people to sign up for health care in 2017.

Also know is potential savings from 2022 inflation reduction acts. CBO originally estimated billions of disability disability, but the most recent estimates show that it can add $ 428 billion in disability. CBO makes such plots that are more important tax cuts in the 2017 package expires at the end of 2025.

If the home version of ‘a large beautiful bill’ passes and finally signed is in the air. In the Senate, two Republicans, Rand Paul, R-Ky., And Ron Johnson, R-Wishmot. deficiency deficiency.

United States – June 1: Si Sen. Rand Paul, R-Ky. (Tom Williams / CQ-Roll Call, Inc. Via Getty Images / Getty Images)

Get Fox’s business to go by clicking here

The Republicans want to pass the bill to the Senate using reconciliation, which requires a simple votes of 60. In most republicans are not dangerous to two votes, or the bill is defeated.